For many investors, the performance of spot ether (ETH) exchange-traded funds (ETFs) has been disappointing.

Whereas spot bitcoin (BTC) ETFs processed almost $19 billion in inflows in the course of 10 months, ether ETFs, which began trading in July, have failed to produce the same kind of interest.

Even worse, Grayscale’s ETHE, which existed as an ether Trust prior to its conversion into an ETF, has suffered massive redemptions, and demand for other ether funds has failed to offset them.

That means ether ETFs have, so far, experienced $556 million in net outflows since they launched. Just this week, the products have bled out a net $8 million, according to Farside data.

So why are ether ETFs performing so differently? There are a few possible reasons.

Putting inflows into context

First of all, it’s important to note that ether ETFs only look bad in contrast to bitcoin ETFs. The bitcoin products have broken so many records that they’re arguably the most successful ETFs of all time.

For example, the ETFs issued by BlackRock and Fidelity, IBIT and FBTC, collected $4.2 billion and $3.5 billion each in their first 30 days, smashing the previous record, held by BlackRock’s Climate Conscious fund, which had garnered $2.2 billion in its first month, August 2023.

While ether ETFs failed to replicate these kinds of earth-shattering results, three of the funds are still among the top 25 best performing ETFs of the year, according to ETF Store president Nate Geraci.

BlackRock’s ETHE, Fidelity’s FBTC, and Bitwise’s ETHW have vacuumed up almost $1 billion, $367 million, and $239 million in assets respectively – not bad at all for two-and-a-half months old funds.

“Spot ether ETFs were never going to challenge spot bitcoin ETFs in terms of inflows,” Geraci told CoinDesk.

“If you look at the underlying spot markets, ether is about one-fourth the market cap of bitcoin. That should be a reasonable proxy of where spot ether ETF demand ends up longer-term relative to spot bitcoin ETFs.”

The problem is that Grayscale’s ETHE has drowned out these funds’ performances with its large outflows.

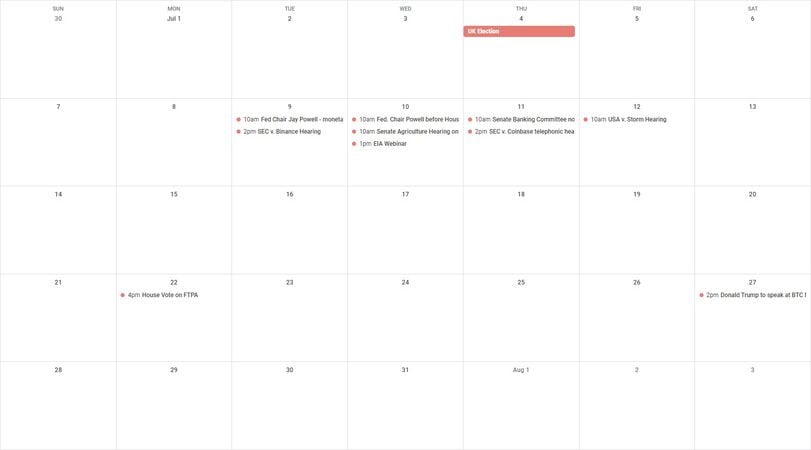

Spun up in 2017 as a trust, ETHE was originally designed, for regulatory reasons, in a way that didn’t permit investors to redeem their ETF shares – the money was stuck in the product. That changed on July 23, when Grayscale won approval to convert its trust into a proper ETF.

At the time of conversion, ETHE had roughly $1 billion in assets, and while some of those assets were moved by Grayscale itself to another of its funds – the ether mini ETF – ETHE has suffered from almost $3 billion in outflows.

It’s worth noting that Grayscale experienced the same thing with its bitcoin ETF, GBTC, which has processed more than $20 billion in outflows since its conversion in January. However, the stellar performances of BlackRock and Fidelity’s spot Bitcoin ETFs have more than offset GBTC’s bleedout.

One of the big differences between bitcoin and ether is that investors can stake ether – essentially locking it into the Ethereum network to earn a yield paid out in ether.

However, in their current form, ether ETFs don’t allow investors to gain exposure to staking. So holding ether through an ETF means missing out on that yield (currently about 3.5%) – and paying a management fee to issuers that can range from 0.15% to 2.5%.

While some traditional investors won’t mind giving up that yield in exchange for the convenience and safety of an ETF, it makes sense for crypto-natives to find alternative ways of holding ether.

“If you’re a competent fund manager with even a basic understanding of the crypto market and you’re managing someone’s money, why would you buy an ether ETF right now?” Adam Morgan McCarthy, an analyst at crypto data firm Kaiko Research, told CoinDesk.

“You pay to get exposure to ETH (and the underlying is custodied at Coinbase) or you buy the underlying yourself and stake it with the exact same provider in return for some yield,” McCarthy said.

Marketing Ethereum to clients

Another obstacle for ether ETFs is that it can be hard for some investors to understand the core use-case for Ethereum because it seeks to lead in several, diverse areas of crypto.

Bitcoin was created with a hard cap on supply: There will never be more than 21 million bitcoin in existence. That makes it relatively easy for investors to see it as “digital gold” and a potential hedge against inflation.

Explaining why a decentralized, open-source smart contract platform matters – and more importantly, why ether stands to accrue in value – is another task altogether.

“One of the challenges for ether ETFs in penetrating the 60/40 Boomer world is distilling its purpose/value into an easy-to-understand soundbite,” Bloomberg Intelligence ETF analyst Eric Balchunas wrote in May.

McCarthy agreed. “Ether is just that bit more complex to get across to people – it’s not built for an elevator pitch,” he told CoinDesk.

It’s no wonder, then, that crypto index fund Bitwise recently launched an educational ad campaign highlighting the technological benefits of Ethereum.

“As investors learn more about stablecoins, decentralized finance, tokenization, prediction markets, and the many other applications powered by Ethereum, they will enthusiastically embrace both technology and the US-listed Ethereum ETPs,” Zach Pandl, head of research at Grayscale, told CoinDesk.

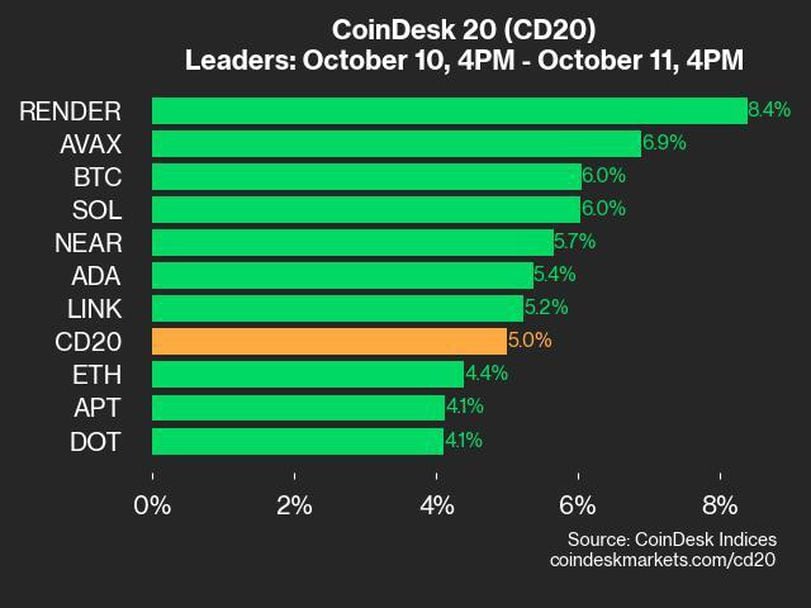

There’s also the fact that ETH itself hasn’t performed all that well compared to BTC this year.

The second largest cryptocurrency by market capitalization is only up 4% since Jan. 1, whereas BTC has risen 42% and keeps hovering around its 2021 all-time highs.

“One factor contributing to the success of the bitcoin ETFs, which remain mostly retail-driven, has been investor animal spirits and fear of missing out, which itself was fueled by BTC’s 65% rise into the ETF launch and subsequent 33% gain since,” Brian Rudick, director of research at crypto trading firm GSR, told CoinDesk.

“ETH’s 30% price decline since its ETFs launched has put a large damper on retail enthusiasm to buy the funds,” Rudick added. “Sentiment around Ethereum is low, with some seeing it as stuck between Bitcoin as the best monetary asset and Solana as the best high-performance smart contract blockchain.”

Finally, there’s a possibility that traditional investors simply don’t find ether’s valuation attractive at these levels.

At a market capitalization of roughly $290 billion, ether already has a higher valuation than any bank in the world except for JPMorgan Chase and Bank of America, which stand at $608 billion and $311 billion respectively.

And while that might seem like an apples-to-oranges comparison, Quinn Thompson, founder of crypto hedge fund Lekker Capital, told CoinDesk that ether’s valuation also looks high compared to tech stocks.

Ether’s valuation “next to other assets

is now uglier because there is no justification for its price on any sort of valuation framework,” Thompson wrote in September. “Either price has to come down, or a new generally accepted valuation framework for the asset needs to be widely accepted.”